Photo By Alexander Mils

Posts may contain affiliate links. As an Amazon Associate, we earn from qualifying purchases and collect a small commission at no cost to you. This helps my blog to keep going. Thank you! For more info, read my disclosure policy.

Here are a few tips on how to get your finances on track in 2019. Start by writing down a to-do-list, with realistic, achievable goals and time frames. Determine the action you are going to take to attain your goal!

Find ways to make extra money

Here is a list of ways to make extra money:

- Babysitting

- Dog walking

- Doing surveys

- Uber/Lyft driver

- Sell on Amazon

- Sell on eBay sell on Facebook marketplace

- Sell on OfferUp

- Run Facebook ads for local businesses

- Create an ebook

- Be a tutor

- Post on social media

- Blogging

- House sit and water plants

- Clean houses

- Snow shovel

- Groom pets

- Run errands

- Have a garage sale

- Post on Nextdoor your talents. Be creative!

Cut down on spending

Write down all your monthly bills and expenses. See what incidentals are on there that you could take off the list.

- Cut down on eating out and getting that morning coffee

- Make your lunch to bring to work or school

- Do meal planning and make a list of what you will need

- Stay away from the sweets

- Look for sales and search when is the best time to purchase certain products and get the best deal

- Shop on eBay, OfferUp, Marketplace, and similar sites for good deals.

- Try not to use credit cards, and save up for large items and pay cash

- Rideshare when you can

Increase your credit score

First off, check your credit report every year, with all three major bureaus. Don’t open too many credit cards. Keep your credit cards low, and pay more than the minimum payment, and pay on time. If you do have negative marks on your credit report, write a letter to explain why those are there. If you file bankruptcy, it can affect your report for up to 10 years.

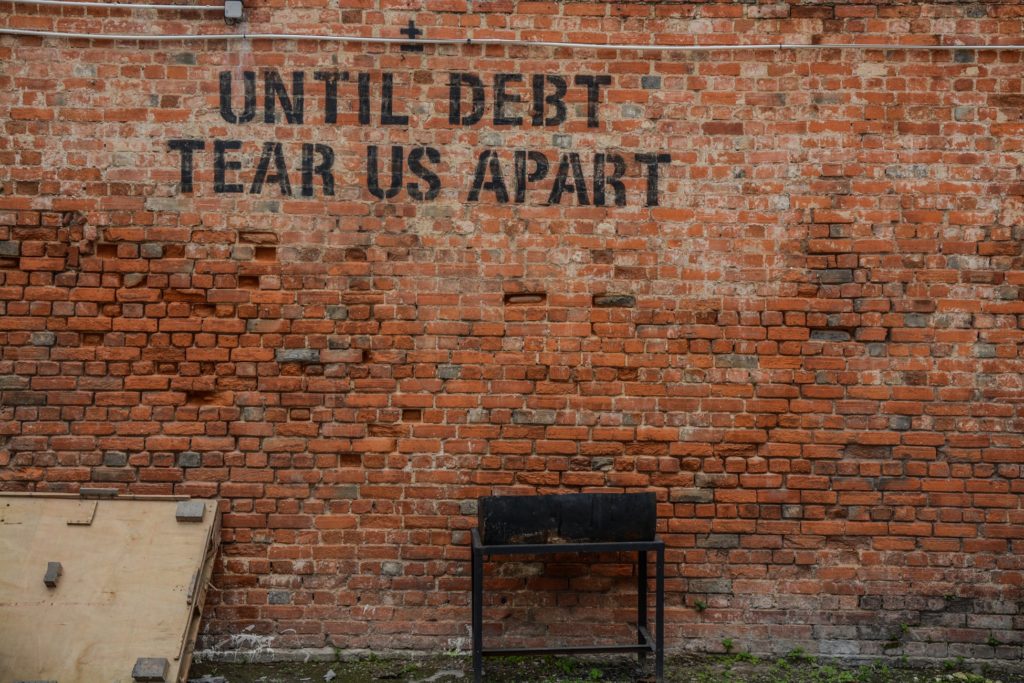

Focus on paying down your debt

The first thing you want to do is create a budget and stick to it! If you follow these tips consistently, eventually you should be able to lower your debt and take a big burden on your shoulders.

- Pay extra on your car payment or other payments when you can.

- In those months where you have 3 pay periods, take that extra check and make an extra payment on your mortgage principal. You will be surprised by how quickly you can pay off the loan when you are consistent in doing this.

- Write down all your bills and payments and see what money you might have extra after you deposit in your savings plans, and pay extra on the lower bills first to see progress. If concerned about interest rates, apply more on the higher bills first.

- Get a side job and put that money towards the debt.

- Use your tax return, bonus, or a raise to apply to your bills.

- Don’t use your credit cards.

- Take advantage of zero or low balance transfers.

- If you receive a bonus put that towards your debt.

- Sell on eBay, OfferUp and Marketplace, or other sites you might like. Use that money to pay your debt.

- Change your spending habits.

Invest in Yourself

Purchase books or take classes that can teach you new learning skills, or attend workshops. Attend webinars, join networking groups with other professionals. Go back to school, or take classes online. Keep learning all you can to open up more opportunities!

Save for the future

Open a savings account and start smaller as you can add more once you feel comfortable with what you are saving.

Start early in contributing to a 401K at your job, and do NOT touch this until you retire if possible. Put in the amount it takes for your company to match your contribution. Companies vary on what they will match and can be up to around 6% of the employee’s pay.

Also, every time you get a raise, increase your contribution by that amount. As you get older go more conservative and increase the contribution as you can. Once you retire roll it over to a traditional IRA. . Do NOT touch this until you retire if possible.

Try to have at least $100,000 when you retire, as you might need to cover huge medical expenses.

Have an emergency savings fund that will be enough to cover your finances for 4 to 6 months, or go above that with what you are comfortable with. So many people were laid off and lost their jobs during the pandemic, so be prepared in case this happens again in the future. Life happens!

Be sure and pay yourself first and save for home repair expenses that arise. This is easier if you have the money taken out and put into another account. This would be separate from your emergency fund.

This can be very expensive if you are not prepared for a huge home repair or have to replace the AC and heating units, replace a roof, replace the fence, or have water damage that insurance doesn’t cover.

In closing

Focus on these tips to keep your financial health as a top priority in your life! You will have less stress and have more purchasing power in buying a home or car. Having a side job has become a popular trend, which can provide extra money for vacations, home remodeling, and big landscaping jobs, or for rainy day savings, to name a few. This way you have the cash to pay and don’t have to worry about putting it on a credit card, which could put your finances in an unhealthy state again.

I am not a financial advisor but am sharing personal experiences and facts from research. Be sure to see your tax advisor on legal financial matters. Below are some books and software to assist you in attaining your financial goals!

If you enjoyed this post and found it to be useful information, please share it with family and friends, and social media.

Here is a post you might enjoy – Steps To Set Succesful Goals in 2021

Subscribe to my YouTube Channel

Join my email list for my free newsletter and other posts on the right sidebar

Visit my my NEW podcast Health Becomes Fitness

See you soon, Denise

Posts may contain affiliate links. As an Amazon Associate, we earn from qualifying purchases and collect a small commission at no cost to you. This helps my blog to keep going. Thank you! For more info, read my disclosure policy.

I love your pragmatic tips about how to make extra money and cut down on expenses. These are strategies I use regularly and I’m proud that by God’s grace I’m debt free.

Thank you for your feedback Betty! Amen to that! It feels so good not to have the weight of debt in your life. My husband and I do repairs and purchases when we have saved the money.